--shortcuts\\:

CBA = Commonwealth Bank

BW = Bankwest

AMEX = American Express

Citi = Citibank

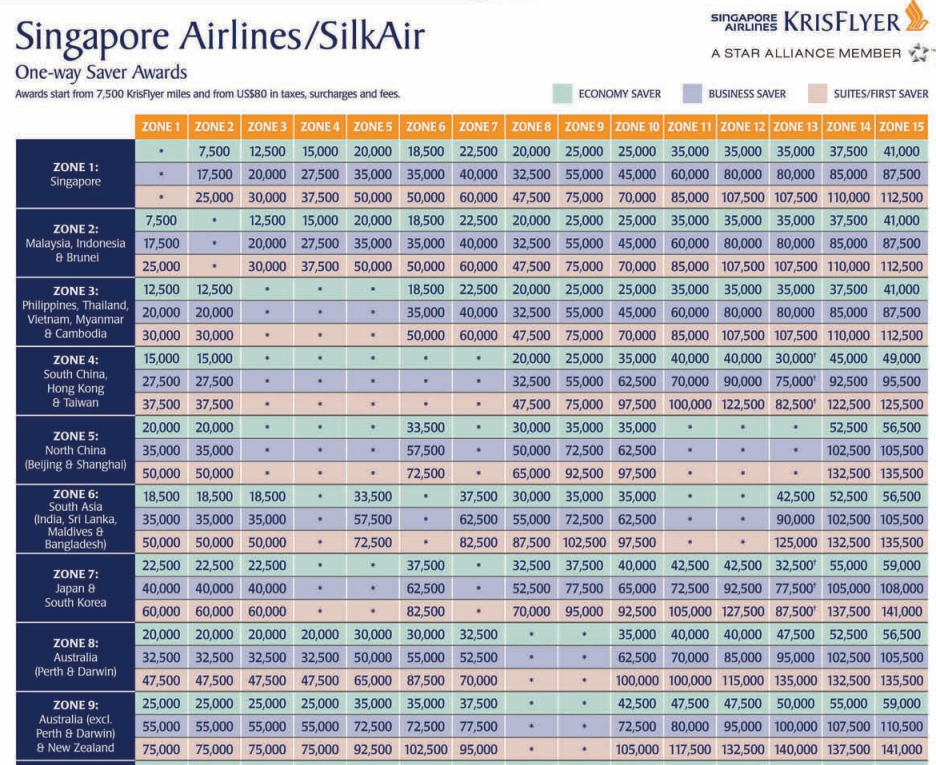

KF = Singapore Airlines Krisflyer

Currently I hold a Citi Visa Card (Signature) and a combo CBA Amex/Master Card (Diamond). Today I signed up for the Amex Platinum Edge. Our end game is to rack up as much KF points as possible to upgrade our next holiday on business.

A bit of history, I signed up with Citi because I had to cancel my previous BW credit card because I didn't want to pay annual fees. Citi had a friends and family offer which waives the annual fee of this reward credit card for life! Initially I signed up without the friends and family offer and was rewarded 60,000 points and $199 annual fee (if I remember correctly). I told them that I was unhappy and would like to cancel the card. Citi then said they can offer me the card for no annual fee but they would have to retract the 60,000 points. I was happy with that re-arrangement but in the end they waive my annual fee for life and DID NOT retract the signing 60,000 point bonus :)

My combo CBA is a freebie because of my mortgage. I was going to replace my Citi Visa with this combo from CBA but it was just hard to let go.

I just signed up to Amex Platinum Edge today after some research.

I have excel up that I can rake up:

CBA AMEX

|

$1

|

1.11 KF points

|

Citi Signature Visa

|

$1

|

0.75 KF points

|

AMEX Plat Edge (Supermarkets)

|

$1

|

3 KF points

|

AMEX Plat Edge (Service Stations)

|

$1

|

2 KF points

|

My game plan:

I am a loyal customer of Myers (I will let you guys in on why next time); with any purchase that I make in Myers I will use my CBA AMEX. All my groceries and fuel charges will fall on my AMEX Platinum Edge and everything else will be put on the Citibank Visa.

My monthly consistent use:

$300 per month for groceries

$200 per month for fuel

My monthly inconsistent use:

$400 per month for Myer shopping

$50 per month for others

If I solely relied on Citi Visa I could rake up 712.5 KF points per month.

If I diversify my card options, I can rake up 1781.94 KF points per month instead!

Let's check out the possibilities below!

Please sign up via my referral link! Thanks

No comments:

Post a Comment